Introduction: Finding Your Perfect Crypto Trading Partner in India

Picture this: You’re ready to dive into cryptocurrency trading, but with dozens of exchanges claiming to be the “best,” how do you choose? I’ve spent countless hours analyzing India’s crypto landscape, and I can tell you that picking the wrong exchange is like building a house on shaky ground – it rarely ends well.

In 2025, the Indian cryptocurrency market has matured significantly, with over 15 million users actively trading digital assets worth billions of rupees. Yet, many traders still struggle with high fees, security concerns, and platforms that feel more like rocket science than simple trading tools.

This comprehensive guide cuts through the noise to reveal India’s top cryptocurrency exchanges, comparing everything from security features to fee structures. You’ll discover which platform suits your trading style, whether you’re a cautious beginner or an experienced trader seeking advanced features.

What you’ll learn:

- The 5 best crypto exchanges operating in India today

- Detailed security comparisons to protect your investments

- Hidden fees that could eat into your profits

- Real user experiences and expert recommendations

- Current regulatory updates affecting Indian traders

Why Choosing the Right Crypto Exchange Matters More Than Ever

The crypto exchange you choose literally holds your financial future in its digital hands. I’ve seen traders lose thousands due to poor exchange selection – from sudden platform shutdowns to security breaches that wiped out entire portfolios.

The Hidden Costs of Wrong Exchange Selection

Recent data shows that traders using suboptimal exchanges lose an average of 12-15% annually to excessive fees alone. That’s money that should be growing your portfolio, not padding exchange profits.

Consider Raj, a Mumbai-based software engineer who started with ₹50,000 on a high-fee exchange. After one year of active trading, he’d paid ₹8,500 in various charges – money that could have bought him additional crypto during market dips.

Security: Your First Line of Defense

With crypto thefts reaching ₹2,300 crores globally in 2024, security isn’t just important – it’s everything. The exchanges we’ll explore have implemented multiple security layers, but understanding these features helps you make informed decisions.

Current Cryptocurrency Landscape in India 2025

India’s crypto adoption has exploded despite regulatory uncertainties. The Reserve Bank of India’s latest data reveals:

- User Base Growth: 340% increase in crypto users since 2022

- Trading Volume: Daily volumes averaging ₹450 crores across major exchanges

- Regulatory Clarity: New framework discussions providing cautious optimism

- Institutional Interest: Growing corporate and institutional adoption

This growth hasn’t gone unnoticed by global players, with several international exchanges either entering or expanding their Indian operations.

Tax Implications Every Trader Must Know

Since April 2022, cryptocurrency gains are taxed at 30% under the new tax regime. Additionally, a 1% TDS applies to all crypto transactions above ₹10,000. This makes choosing a tax-compliant exchange crucial for avoiding future complications.

Top 5 Crypto Exchanges in India: Detailed Analysis

1. WazirX: The Binance-Backed Powerhouse

Founded: 2018 | Users: 4+ million | Cryptocurrencies: 200+

WazirX has transformed from a startup to India’s most recognizable crypto exchange, largely due to its Binance acquisition. The platform strikes an impressive balance between beginner-friendliness and advanced features.

Key Strengths:

- Binance Integration: Access to global liquidity and advanced trading options

- P2P Trading: Direct peer-to-peer transactions with multiple payment methods

- Security: Multi-signature cold storage and advanced encryption

- Mobile Experience: Intuitive app with 4.2+ star rating

Fee Structure:

- Trading: 0.2% maker/taker fees

- Withdrawal: Varies by cryptocurrency (₹10-100 for INR)

- Deposit: Free for most methods

Real User Experience: Priya, a Chennai-based trader, shares: “I’ve been using WazirX for two years. The Binance connection gives me confidence, and I’ve never faced major issues with deposits or withdrawals.”

Best For: Intermediate traders seeking global market access with Indian payment convenience.

2. CoinDCX: The Feature-Rich Trading Hub

Founded: 2018 | Users: 3+ million | Cryptocurrencies: 200+

CoinDCX positions itself as India’s most comprehensive crypto platform, offering everything from spot trading to futures, lending, and even crypto-backed loans.

Standout Features:

- CoinDCX Go: Simplified app for beginners

- Advanced Trading: Professional-grade charts and order types

- Lending Platform: Earn interest on crypto holdings

- Insurance Coverage: ₹50 crore insurance against security breaches

Fee Analysis:

- Spot Trading: 0.1% maker, 0.1% taker

- Futures Trading: 0.05% maker, 0.05% taker

- Withdrawal: Competitive rates across all assets

Why Traders Choose CoinDCX: The platform’s dual approach – CoinDCX Go for beginners and CoinDCX Pro for advanced users – means you won’t outgrow the platform as your skills develop.

Best For: Serious traders wanting comprehensive features and competitive fees.

3. ZebPay: The Veteran’s Choice

Founded: 2014 | Users: 2+ million | Cryptocurrencies: 50+

As one of India’s oldest exchanges, ZebPay has weathered regulatory storms and emerged stronger. Their focus on security and simplicity has earned loyal users who value stability over bells and whistles.

Core Advantages:

- Cold Storage: 95% of funds stored offline

- Compliance: Strong regulatory compliance track record

- Educational Resources: Comprehensive learning materials

- Customer Support: 24/7 support with faster response times

Fee Transparency:

- Trading: 0.15% across all pairs

- INR Deposits: Free

- Withdrawals: Minimal fees with no hidden charges

Security Track Record: ZebPay’s decade-long operation without major security incidents speaks volumes about their infrastructure quality.

Best For: Conservative traders prioritizing security and regulatory compliance.

4. Bitbns: The Innovation Leader

Founded: 2017 | Users: 1.5+ million | Cryptocurrencies: 150+

Bitbns consistently introduces innovative features that other exchanges later adopt. Their systematic investment plans (SIPs) for crypto and margin trading options attract diverse trader segments.

Innovative Features:

- Crypto SIPs: Regular investment plans like mutual funds

- Margin Trading: Up to 3x leverage on select cryptocurrencies

- Fixed Deposits: Earn guaranteed returns on crypto holdings

- Multi-Language Support: Interface in Hindi and regional languages

Cost Structure:

- Trading: 0.25% standard fee

- SIP Plans: No additional charges

- Margin Trading: Competitive interest rates

User Feedback: Amit from Delhi notes: “Bitbns’ SIP feature helped me build a disciplined crypto investment habit. I’ve been investing ₹5,000 monthly in Bitcoin for 18 months.”

Best For: Long-term investors seeking systematic investment options.

5. Unocoin: The Reliability Champion

Founded: 2013 | Users: 1+ million | Cryptocurrencies: 30+

Unocoin’s decade-plus journey makes it India’s most experienced crypto exchange. While their cryptocurrency selection is limited, their focus on major coins and rock-solid security appeals to risk-averse investors.

Key Differentiators:

- Systematic Buying Plans (SBP): Automated regular purchases

- Bill Payments: Pay utility bills using Bitcoin

- Biometric Security: Advanced app security features

- Merchant Solutions: Accept crypto payments for businesses

Pricing Model:

- Trading: 0.7% on buy/sell transactions

- SBP: No additional fees

- Withdrawals: Competitive rates for supported coins

Target Audience: Beginners and conservative investors preferring established, major cryptocurrencies.

Comprehensive Comparison: Making Your Decision

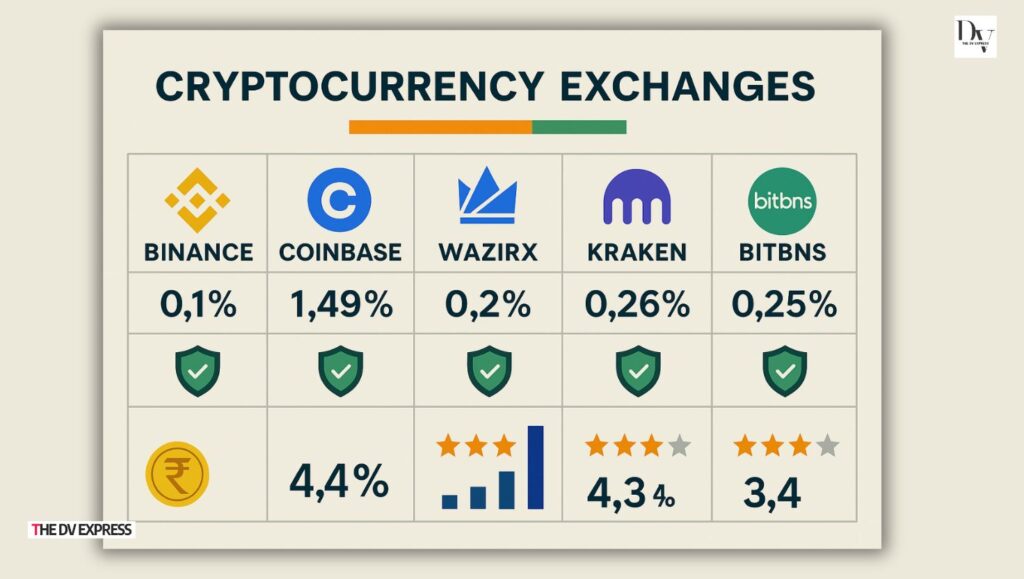

Fee Comparison Analysis

ExchangeTrading FeesWithdrawal FeesHidden CostsWazirX0.2%Low-MediumMinimalCoinDCX0.1%LowTransparentZebPay0.15%LowNoneBitbns0.25%MediumClear disclosureUnocoin0.7%MediumTransparent

Winner: CoinDCX for active traders, ZebPay for overall value.

Security Feature Comparison

All featured exchanges implement:

- Two-factor authentication (2FA)

- Cold storage for majority of funds

- SSL encryption for all communications

- Regular security audits

Additional Security Leaders:

- CoinDCX: Insurance coverage

- ZebPay: 95% cold storage ratio

- Unocoin: Biometric authentication

User Experience Rankings

Based on app store ratings and user surveys:

- WazirX: 4.2/5 – Intuitive design, smooth navigation

- CoinDCX: 4.1/5 – Feature-rich but well-organized

- ZebPay: 4.0/5 – Simple, reliable interface

- Bitbns: 3.8/5 – Powerful but complex

- Unocoin: 3.9/5 – Basic but functional

Cryptocurrency Selection

Most Diverse: CoinDCX and WazirX (200+ coins each) Focused Selection: ZebPay and Unocoin (major coins only) Balanced Approach: Bitbns (popular altcoins included)

Understanding India’s Crypto Regulatory Environment

Current Legal Framework (2025 Update)

The Indian government’s stance on cryptocurrency has evolved significantly:

What’s Legal:

- Trading cryptocurrencies on registered exchanges

- Holding digital assets as investments

- Inter-exchange transfers

What’s Restricted:

- Using crypto as legal tender

- Unregulated/anonymous trading

- Transactions exceeding certain thresholds without documentation

Tax Compliance Essentials

Every crypto trader must understand:

30% Tax Rate: Applied to all crypto gains 1% TDS: Deducted on transactions above ₹10,000 Record Keeping: Maintain detailed transaction logs Reporting Requirements: Include crypto gains in income tax returns

Pro Tip: Use exchanges that provide detailed tax reports to simplify compliance.

Future Regulatory Outlook

Industry experts anticipate:

- Clearer regulatory framework by late 2025

- Possible central bank digital currency (CBDC) integration

- Enhanced compliance requirements for exchanges

- Potential investor protection measures

Expert Recommendations by Trader Type

For Complete Beginners

Recommended: ZebPay or WazirX Why: Simple interfaces, educational resources, strong security Starting Amount: ₹5,000-10,000 Focus: Learn basics with major cryptocurrencies only

For Active Day Traders

Recommended: CoinDCX Pro Why: Low fees, advanced charts, multiple order types Requirements: Strong technical analysis skills Capital: ₹50,000+ for effective trading

For Long-term Investors

Recommended: Bitbns (for SIPs) or CoinDCX (for variety) Why: Systematic investment options, portfolio diversification Strategy: Regular monthly investments Time Horizon: 3+ years

For Experienced Traders

Recommended: WazirX (Binance access) or CoinDCX Pro Why: Advanced features, global market access, competitive fees Features Needed: Futures trading, margin capabilities Risk Tolerance: High

Advanced Trading Strategies and Features

Dollar-Cost Averaging (DCA) in INR

Most exchanges now offer automated DCA features:

- Bitbns SIP: Invest fixed amounts weekly/monthly

- CoinDCX Systematic Plans: Flexible scheduling options

- Unocoin SBP: Simple, reliable automation

Example Strategy: Invest ₹5,000 monthly in Bitcoin regardless of price, reducing volatility impact over time.

Staking and Earning Opportunities

Available Options:

- CoinDCX: Lending platform with 6-12% annual returns

- WazirX: Staking pools for selected cryptocurrencies

- ZebPay: Fixed deposit-like crypto products

Risk Consideration: While attractive, these products involve smart contract risks and market volatility.

Margin Trading Guidelines

For qualified traders, margin trading amplifies both gains and losses:

Bitbns Margin: Up to 3x leverage Risk Management: Never risk more than 5% of portfolio Stop Losses: Essential for limiting downside

Security Best Practices for Indian Crypto Traders

Exchange-Level Security

What to Verify:

- Cold storage percentage (minimum 90%)

- Insurance coverage details

- Security audit reports

- Compliance certifications

Personal Security Measures

Essential Steps:

- Enable 2FA: Use authenticator apps, not SMS

- Unique Passwords: Different for each exchange

- Withdrawal Whitelisting: Restrict withdrawal addresses

- Regular Monitoring: Check accounts daily

- Hardware Wallets: For long-term storage

Red Flags to Avoid:

- Exchanges promising unrealistic returns

- Platforms without proper KYC procedures

- Suspicious withdrawal delays

- Lack of customer support responses

Handling Regulatory Changes

Stay Informed:

- Follow official government announcements

- Join reputable crypto communities

- Monitor exchange compliance updates

- Maintain detailed transaction records

Common Mistakes and How to Avoid Them

Mistake 1: Choosing Based on Marketing Alone

Problem: Flashy advertisements don’t guarantee platform quality Solution: Focus on security audits, user reviews, and regulatory compliance

Mistake 2: Ignoring Fee Structures

Problem: Hidden fees can significantly impact returns Solution: Calculate total costs including trading, withdrawal, and conversion fees

Mistake 3: Inadequate Security Measures

Problem: Weak security leads to account compromises Solution: Implement all available security features immediately

Mistake 4: FOMO-Driven Platform Switching

Problem: Constantly changing exchanges disrupts trading strategies Solution: Choose one primary exchange and stick with it unless major issues arise

Mistake 5: Neglecting Tax Compliance

Problem: Inadequate record-keeping creates tax complications Solution: Use exchanges with built-in tax reporting features

Frequently Asked Questions

What should I look for in a crypto exchange?

The most important factors are security features (cold storage, 2FA, insurance), fee transparency, regulatory compliance, customer support quality, and available cryptocurrencies. For beginners, prioritize user-friendly interfaces and educational resources.

Which crypto exchange has the lowest fees in India?

CoinDCX offers the most competitive trading fees at 0.1% for both makers and takers. However, consider total costs including withdrawal fees and any additional charges for your specific trading patterns.

Is cryptocurrency trading legal in India?

Yes, cryptocurrency trading is legal in India. However, crypto gains are taxed at 30%, and a 1% TDS applies to transactions above ₹10,000. Always trade on compliant exchanges and maintain proper records.

How much money do I need to start crypto trading?

Most exchanges allow trading with as little as ₹100, but I recommend starting with ₹5,000-10,000 to learn effectively. This amount allows for diversification and covers potential fees without significant financial stress.

Should I use multiple crypto exchanges?

While possible, beginners should start with one reputable exchange to avoid confusion. Advanced traders might use multiple platforms for specific features like lower fees, unique cryptocurrencies, or advanced trading tools.

What happens if a crypto exchange shuts down?

Reputable exchanges maintain cold storage and insurance to protect user funds. However, this risk emphasizes the importance of choosing established, well-regulated platforms and not storing large amounts on exchanges long-term.

How do I secure my crypto investments?

Enable all security features (2FA, withdrawal whitelisting), use unique passwords, monitor accounts regularly, and consider hardware wallets for long-term storage. Never share private keys or login credentials.

Can I trade crypto on mobile apps?

Yes, all major Indian exchanges offer mobile apps with full trading functionality. Apps often provide better user experiences than web platforms, especially for beginners.

Conclusion: Making Your Final Decision

Choosing the best crypto exchange in India isn’t about finding a one-size-fits-all solution – it’s about matching platform strengths with your specific needs, risk tolerance, and trading goals.

For most beginners, ZebPay or WazirX offer the ideal combination of security, simplicity, and support. Their user-friendly interfaces won’t overwhelm you while learning crypto basics.

Active traders should seriously consider CoinDCX for its competitive fees and comprehensive features, or WazirX for global market access through Binance integration.

Long-term investors will appreciate Bitbns’ systematic investment plans or CoinDCX’s diverse cryptocurrency selection for portfolio building.

Remember these key points:

- Security should never be compromised for convenience

- Understand all fees before committing significant capital

- Start small while learning platform features

- Maintain proper tax records from day one

- Stay informed about regulatory developments

The Indian cryptocurrency market will continue evolving, and the exchanges that prioritize security, compliance, and user experience will emerge as long-term winners. Choose wisely, trade responsibly, and remember that successful crypto investing requires patience, education, and disciplined risk management.

Your crypto journey starts with selecting the right exchange – use this guide to make an informed decision that serves your financial goals for years to come.

Divyanshita Singh is a practicing Chartered Accountant and SEBI Registered Investment Advisor with 5+ years of experience in personal finance and investment planning. She has guided 200+ clients and managed portfolios worth over ₹2 crores. [Read full bio →]